Table of Contents

PROSPECTUS

Filed Pursuant to Rule 424(b)(1)

Registration No. 333-251823

30,098,824 Class A Common Shares

Patria Investments Limited

(incorporated in the Cayman Islands)

This is an initial public offering of the Class A common shares, US$0.0001 par value per share of Patria Investments Limited, or Patria. Patria is offering 16,650,000 of the Class A common shares to be sold in this offering. The selling shareholder identified in this prospectus is offering 13,448,824 of the Class A common shares to be sold in the offering. We will not receive any proceeds from the sale of Class A common shares by the selling shareholder. Prior to this offering, there has been no public market for our Class A common shares. The initial public offering price per Class A common share is US$17.00. Our Class A common shares have been approved for listing on the Nasdaq Global Select Market, or Nasdaq, under the symbol “PAX.”

Following this offering, our existing shareholders, Patria Holdings Limited, or Patria Holdings, and Blackstone PAT Holdings IV, L.L.C., or Blackstone, will beneficially own 77.5% of our issued and outstanding share capital, assuming no exercise of the underwriters’ option to purchase additional shares referred to below. The shares held by Patria Holdings are Class B common shares, which carry rights that are identical to the Class A common shares being sold in this offering, except that (i) holders of Class B common shares are entitled to 10 votes per share, whereas holders of our Class A common shares are entitled to one vote per share, (ii) Class B common shares have certain conversion rights, and (iii) holders of Class B common shares are entitled to preemptive rights in the event that additional Class A common shares are issued in order to maintain their proportional ownership interest. For further information, see “Description of Share Capital.” As a result, Patria Holdings will control approximately 94.1% of the voting power of our issued and outstanding share capital following this offering, assuming no exercise of the underwriters’ option to purchase additional shares.

We are an “emerging growth company” under the U.S. federal securities laws as that term is used in the Jumpstart Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements. Investing in our Class A common shares involves risks. See “Risk Factors” beginning on page 26 of this prospectus.

| Per Class A common share |

Total | |||||||

| Initial public offering price |

US$ | 17.00 | US$ | 511,680,008 | ||||

| Underwriting discounts and commissions |

US$ | 1.19 | US$ | 35,817,601 | ||||

| Proceeds, before expenses, to us(1) |

US$ | 15.81 | US$ | 263,236,500 | ||||

| Proceeds, before expenses, to the selling shareholder(1) |

US$ | 15.81 | US$ | 212,625,907 | ||||

| (1) | See “Underwriting” for a description of all compensation payable to the underwriters. |

We and the selling shareholder have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 4,514,823 additional Class A common shares at the initial public offering price, less underwriting discounts and commissions.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We and the selling shareholder expect to deliver the Class A common shares against payment in New York, New York on or about January 26, 2021 through the facilities of the Depository Trust Company.

Global Coordinators

| J.P. Morgan | BofA Securities | Credit Suisse |

Joint Bookrunner

Goldman Sachs & Co.

Co-Managers

| Bradesco BBI | BTG Pactual | Itaú BBA |

| Keefe, Bruyette & Woods | Santander | XP Investments | ||

| A Stifel Company | ||

The date of this prospectus is January 21, 2021.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 19 | ||||

| 23 | ||||

| 26 | ||||

| 83 | ||||

| 89 | ||||

| 91 | ||||

| 92 | ||||

| 94 | ||||

| 95 | ||||

| 97 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

99 | |||

| 123 | ||||

| 151 | ||||

| 160 | ||||

| 192 | ||||

| 198 | ||||

| 201 | ||||

| 203 | ||||

| 221 | ||||

| 223 | ||||

| 228 | ||||

| 244 | ||||

| 245 | ||||

| 245 | ||||

| 246 | ||||

| 249 | ||||

| F-1 | ||||

Neither we, the selling shareholder nor the underwriters have authorized anyone to provide any information other than, or make any representation about this offering that is different from, or in addition to, that which is contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We and the selling shareholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling shareholder and the underwriters have not authorized any other person to provide you with different or additional information. Neither we, the selling shareholder nor the underwriters are making an offer to sell, or seeking an offer to buy, the Class A common shares in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the Class A common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

For investors outside the United States: Neither we, the selling shareholder, any of the underwriters nor any of their affiliates have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and

i

Table of Contents

observe any restrictions relating to, the offering of our Class A common shares and the distribution of this prospectus outside the United States.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

Market data used throughout this prospectus is based on management’s knowledge of the industry and the good faith estimates of management. All of management’s estimates presented are based on industry sources, including analyst reports and management’s knowledge. We also relied, to the extent available, upon management’s review of independent industry surveys and publications prepared by a number of sources and other publicly available information. We are responsible for all of the disclosure in this prospectus and we believe that each of the publications, studies and surveys used throughout this prospectus are prepared by reputable sources and are generally reliable, though we have not independently verified market and industry data from third-party sources. None of the publications, reports or other published industry sources referred to in this prospectus were commissioned by us or prepared at our request. We have not sought or obtained the consent of any of these sources to include such market data in this prospectus. All of the market data used in this prospectus involves a number of assumptions and limitations and therefore is inherently uncertain and imprecise, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Patria” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Patria Investments Limited, together with its subsidiaries; Patria’s consolidated financial statements are included elsewhere in this prospectus. All references to Patria Brazil refers to Patria Investimentos Ltda.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to the Brazilian Central Bank (Banco Central do Brasil). References in the prospectus to “real,” “reais,” “Brazilian real,” “Brazilian reais,” or “R$” are to the Brazilian real, the official currency of Brazil. References to “U.S. dollar,” “U.S. dollars” or “US$” refer to U.S. dollars, the official currency of the United States of America and our functional currency. Unless stated otherwise, we have translated real amounts into U.S. dollars using a rate of R$5.641 to US$1.00, the commercial purchase rate for U.S. dollars as of September 30, 2020 as reported by the Central Bank.

All references to the “Companies Act” are to the Companies Act (2020 Revision) of the Cayman Islands as may be amended from time to time.

All references to “emerging growth company” shall have the meaning associated with that term in the Jumpstart Our Business Startups Act of 2012.

ii

Table of Contents

This prospectus summary highlights information contained elsewhere in this prospectus. This summary may not contain all the information that you should consider in making your investment decision, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Class A common shares.

Overview

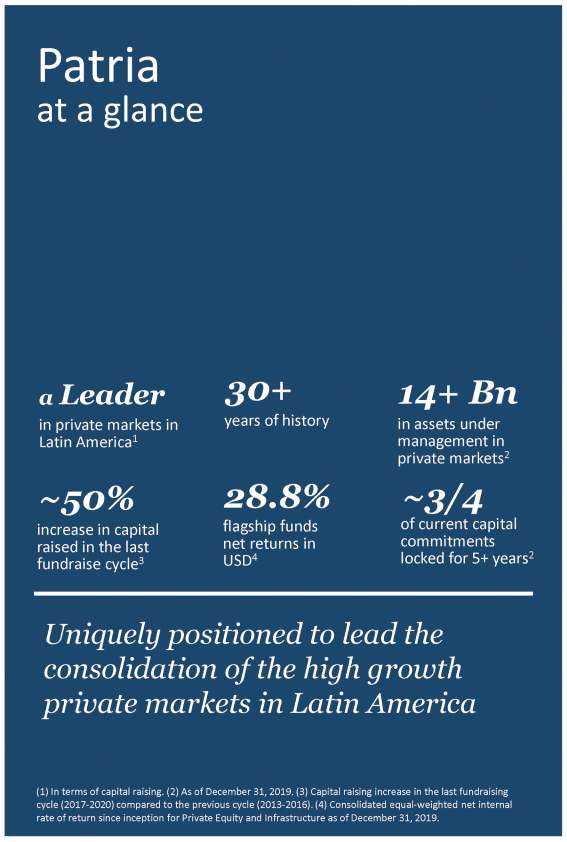

We are one of the leading private markets investment firms in Latin America in terms of capital raised, with over US$8.7 billion raised since 2015 including co-investments. Preqin’s 2020 Global Private Equity & Venture Capital Report ranks us as the number one fund manager by total capital raised for private equity funds in the past 10 years in Latin America. As of September 30, 2020 and December 31, 2019, our assets under management, or AUM, was US$12.7 billion and US$14.7 billion, respectively, with 16 and 15 active funds, respectively, as of the same dates, and our investment portfolio was composed of over 55 and 50 companies and assets, respectively, as of the same dates. Our size and performance over our 32-year history also make us one of the most significant emerging markets-based private markets investments managers.

We seek to provide global and Latin American investors with attractive investment products that allow for portfolio diversification and consistent returns. Our investment approach seeks to take advantage of sizable opportunities in Latin America while mitigating risks such as macroeconomic and foreign exchange volatility. We do so by focusing on resilient sectors—largely uncorrelated with macroeconomic factors—driving operational value creation, and partnering with entrepreneurs and management teams to develop some of the leading platforms in the region. Our strategy, applied since 1994 in our flagship private equity products (US$7.2 billion and US$8.5 billion in AUM as of September 30, 2020 and December 31, 2019, respectively, and in its 6th vintage) and since 2006 in our flagship infrastructure products (US$4.6 and US$4.8 billion in AUM as of September 30 2020 and December 31, 2019, respectively, and in its 4th vintage), has generated solid returns and sustained growth. The consolidated equal-weighted net internal rate of return, or IRR, in U.S. dollars for all our flagship private equity and infrastructure products since inception was 28.3% and 28.8% as of September 30, 2020 and December 31, 2019, respectively (30.1% and 30.7% in Brazilian reais, respectively). We have overseen the deployment of more than US$17.0 billion through capital raised by our products, capital raised in IPOs and follow-ons, debt raised by underlying companies and capital expenditures sourced from operational cash flow of underlying companies, with more than 90 investments and over 215 underlying acquisitions as of September 30, 2020.

Our successful track record derived from our strategy and our strong capabilities has attracted a committed and diversified base of investors, with over 300 Limited Partners, or LPs, across four continents, including some of the world’s largest and most important sovereign wealth funds, public and private pension funds, insurance companies, funds of funds, financial institutions, endowments, foundations, and family offices. We have built long-term and growing relationships with our LPs: as of September 30, 2020, more than 60% of our current LPs have been investing with us for over 10 years and approximately 80% of our capital raised came from LPs who invested in more than one of our products. We believe our strategy and team have benefited from the investment of our partner, The Blackstone Group Inc., one of the world’s leading investment firms, which has held a non-controlling interest in our firm since 2010. We believe our historical returns in U.S. dollars are particularly notable in view of the levels of currency volatility and our historically limited use of leverage, which, we also believe, made us better investors focused on value creation, strategy execution and operational excellence, with more limited reliance upon financial engineering.

1

Table of Contents

Consistent with our entrepreneurial culture and our aim to provide attractive investment opportunities to our growing and progressively more sophisticated client base, we have applied our core competencies to develop other products around our strategy. From our initial flagship private equity funds, we developed other investment options, such as our successful infrastructure funds, co-investments funds (focused on successful companies from our flagship funds) constructivist equity funds (applying our private equity approach to listed companies), as well as other products based on our Brazil-specific products, such as our real estate and credit solutions funds.

As of September 30, 2020, we had 157 professionals, of which 46 were partners and directors, 20 of these working together for more than ten years, operating in ten offices around the globe, including investment offices in, Montevideo (Uruguay), São Paulo (Brazil), Bogotá (Colombia), and Santiago (Chile), as well as client-coverage offices in New York and Los Angeles (United States), London (United Kingdom), Dubai (UAE), and Hong Kong (China) to cover our LP base, in addition to our corporate business and management office in George Town (Cayman Islands).

Distribution Structure | Global Presence

Source: Internal analysis. As of September 30, 2020. Geographic allocation does not include Patria GP commitments.

| (1) | The real/U.S. dollar exchange rate reported by the Central Bank was R$5.641 per US$1.00 on September 30, 2020. |

Our Business

As an asset manager, our AUM is one of our most important key performance indicators, or KPIs, illustrating the evolution of our business in size, products, and capacity to generate revenues. We believe that the growth of our AUM is directly supported by our performance, and our ability to invest these assets to produce attractive risk-adjusted returns. Our calculation of AUM may differ from the calculations of other investment managers and, as a result, may not be comparable to similar metrics presented by other investment managers. AUM is defined in the section “Presentation of Financial and Other Information—Certain Terms Used in this Prospectus as KPIs to Measure Operating Performance.”

From December 31, 2009 to December 31, 2019, our AUM increased from US$2.4 billion to US$14.7 billion at a compounded annual growth rate, or CAGR, of 20% per year (and an AUM of

2

Table of Contents

US$12.7 billion as of September 30, 2020). Our fee earning AUM, or FEAUM, defines the effective capital managed by us on which we derive management fees at a given time and as of September 30, 2020 and December 31, 2019 was US$6.9 billion and US$6.8 billion, respectively. As of December 31, 2019, further to the US$6.8 billion, we had a balance of over US$3 billion of committed capital to be deployed by our funds which were paying fees over the deployed capital, indicating a US$3 billion potential additional FEAUM (US$3.2 billion as of September 30, 2020). For more details on our annual performance, see “Business—Our Business.” Our AUM, in addition to our FEAUM, considers the appreciation of the assets and the capital under management which is not generating management fees at a given time, such as the committed and not yet deployed capital of funds, which charge management fees over the deployed capital. Another important indicator is our performance revenue eligible AUM, as it represents the total capital at fair value, on which performance fees and/or incentive fees could be earned if certain targets are met. As of September 30, 2020 and December 31, 2019 approximately 80% of our total AUM was Performance Revenue Eligible AUM. The following chart illustrates our AUM growth curve:

AUM Patria (US$ billion)

| (1) | Brazil-specific products include Real Estate and Credit funds, and our Constructivist Equity Fund. There can be no guarantee that we will achieve comparable growth metrics in the future. |

As of September 30, 2020 and December 31, 2019, approximately 90% of our AUM was concentrated in our two flagship products: private equity and infrastructure. Our Brazil-specific products include private credit funds and real estate funds, in addition to our Constructivist Equity Fund, or CEF, detailed below.

We have developed our private equity products since 1994, applying our investment approach to create leading companies in resilient sectors, such as healthcare and logistics. As of September 30, 2020 and December 31, 2019, our private equity product was in its 6th vintage with over US$7.2 billion and US$8.5 billion of AUM, respectively, with approximately 40 investments and 200 underlying acquisitions for the same periods. As of September 30, 2020 and December 31, 2019, the consolidated cash-weighted net IRR since inception for all our private equity products was 13.7% and 16.1% in U.S. dollars and 20.4% and 20.8% in Brazilian reais, respectively, with limited use of leverage.

We believe we have built one of the leading infrastructure investment products in Latin America in terms of AUM, considering our US$4.6 billion and US$4.8 billion of AUM as of September 30, 2020 and December 31, 2019, respectively, and offered approximately US$1.0 billion of co-investment opportunities to date since its inception in 2006. As of September 30, 2020 and December 31, 2019, our infrastructure products had a consolidated cash-weighted net IRR since inception of 4.8% and 10.1% in U.S. dollars and 19.5% and 20.3% in Brazilian reais, respectively.

3

Table of Contents

Our CEF was launched in 2014 as a natural evolution of our successful private equity products, in order to take advantage of value creation opportunities in publicly listed companies in Brazil, while allowing clients access to our investment approach by means of a more liquid product. As of September 30, 2020 and December 31, 2019, our CEF had approximately US$200.0 million of AUM and a net compounded annualized return of 34.3% and 40.1% in Brazilian reais, or 16.2% and 26.7% in U.S. dollars, respectively.

Market Opportunity

The global savings industry has been impacted over the last decades by a liquidity boom that has made the global financial asset base grow from 6.5x global gross domestic product, or GDP, in 1990 to nearly 10x GDP in 2019. According to Preqin, AUM across private markets reached an all-time high of US$7.3 trillion in 2019 (excluding hedge funds and funds of funds), almost doubling since 2014. Private markets’ AUM grew at a compounded annual rate of approximately 13.4% in the last five years, outperforming the already favorable 9% per year recorded during the 2010-14 period. Similarly, with respect to capital raising, 2017 marked the first time that capital raised activity in private markets exceeded that of public markets in the United States, while the number of listed companies in the main U.S. stock markets fell to 4,397 in 2018 against a peak of approximately 8,100 in 1996.

We believe that the industry trends and opportunities in Brazil and in Latin America more broadly are similar. According to the Brazilian Financial and Capital Markets Association (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais), or ANBIMA, the total private markets asset base in Brazil has experienced a compound annual growth rate of 23% from 2009 to 2019, reaching an all-time-high of R$625.0 billion (approximately US$120.0 billion) in 2019 making private markets one of the fastest-growing asset classes within the asset management industry in the country. Yet, relative to other more developed economies, private markets in Brazil and elsewhere in Latin American are still in early stages and we expect inflows to such asset classes to strengthen.

The solid growth of investments in private markets, both in Brazil and Latin America as well as globally, has been driven by secular trends that we believe will continue to boost investor’s allocation to the industry, including the following:

| • | Significant liquidity available in financial markets, given the solid expansion in investible capital from institutional investors and individuals—BCG’s 2020 Global Assets Management Report shows that total global market AUM grew 7% per year between 2014 and 2019, and forecasts it will grow 4% per year for the following 5 years (2019-2024). Private markets AUM is expected to grow even faster. According to Preqin’s The Future of Alternatives 2020 study, private markets AUM is expected to reach US$12.9 trillion by 2025 with a 12.4% CAGR from 2020 to 2025. According to Preqin, institutional investors plan to increase allocations across most asset classes within private markets, particularly in real estate (51% of respondents), infrastructure (66%), private debt (67%), and private equity (79%). |

| • | Institutional Investors searching for higher returns as they face challenges to reach their target returns in a low-yield environment—In the United States alone, the liability gap of U.S. public pension funds has widened substantially, reaching US$4.9 trillion by September 30, 2020, or close to 45% in assets-to-liabilities ratio, or A/L, from approximately US$1.6 trillion (67% A/L) in 2007. Given the business dynamics of institutional investors, allocation horizons tend to be longer, and illiquidity characteristics of private markets are usually tolerated in exchange for the prospect of higher returns. Indeed, allocations from pension funds into private markets assets has grown substantially in recent years and are expected to continue as one of the strategies to reduce such liability gap. |

| • | Family offices, private banks and HNWIs, who are seeking higher yields—Private markets have historically been an investment alternative mostly for institutional players. In recent years, however, |

4

Table of Contents

| general partners, or GPs, and other private asset distributors have realized the significant potential and latent demand of other segments such as family offices, high net worth individuals, or HNWIs, and retail investors. According to data from Morningstar, total AUM of listed alternative open-ended funds and exchange-traded funds, or ETFs, in Europe grew from less than EUR50.0 billion in 2008 to close to EUR450.0 billion in 2018, a 9.3x increase in the period. A survey from UBS with 360 family offices globally showed that alternatives and private market investments already hold an almost equal share in their portfolios compared to more traditional assets such as public equities and fixed income products (41.2% vs. 48.7%, respectively), and that capital allocation to the first group is likely to increase in the future in light of these families’ expectations—three out of the five most cited asset classes for allocation increase are private markets products, with private equity leading the list. |

| • | Consistent historical outperformance of private markets vs. public markets—A key benchmark used by investors and managers to assess investments in private markets is to compare their returns to the public markets equivalent, or PME, as both markets involve primarily equity investments. The PME methodology replicates the same investment cash flow (based on contributions and distributions) seen in a private equity investment to a chosen public market index and estimates its return. Historically, private markets funds’ returns have generally outperformed public markets investments, as shown by calculations using PME. A study from Cambridge Associates indicates an outperformance spread in returns of 460 bps for the S&P 500 modified public market equivalent methodology (which replicates private investment performance under public market conditions), or mPME, and more than 1,300 bps for the MSCI Europe mPME in favor of their private market counterparts over a five-year time horizon ending in March 2020, and the same picture holds irrespective of the period of analysis (5, 10 or 20 years). Please see the chart titled “Horizon pooled return compared to modified Public Market Equivalent (mPME) | As of March 31, 2020” in “Industry—Global Private Markets—Consistent historical outperformance of private markets vs. public markets” for additional information on the historical outperformance of private markets compared to public markets. |

| • | Development of liquidity alternatives through secondary funds—The secondary market for private markets assets is key to the development of the industry, as it creates a liquidity alternative for investors, reducing the typical withdrawal restrictions and consequently boosting appetite for new allocations. The global AUM of secondary products grew at a 14% CAGR from 2010 to 2019, coming from a robust average growth of 10% per year from 2010-2015 and accelerating to 18% per year from 2016-2019, reaching a total of US$300.0 billion globally (please see the chart titled “Secondaries AUM by Year (US$ billion)” in “Industry—Global Private Markets—Consistent historical outperformance of private markets vs. public markets” for details of the AUM curve). |

In addition to these secular trends, we believe there is a specific opportunity in Latin America given the very low penetration of private markets’ asset base to GDP in comparison to other more mature markets. Private markets’ asset base in Brazil, for example, represents only 2.4% of the Brazilian GDP compared to an average of 8.3% of GDP globally and between 10% and 30% in countries such as Canada, Singapore, the United States and the United Kingdom. Moreover, we believe that Latin America, given its lower correlation to the U.S. and E.U. economies, represents a favorable diversification alternative for global investors who seek to rebalance their portfolios and increase exposure to emerging markets.

We believe we are also uniquely positioned to reap the benefits of a fast-developing Latin American market in capital raising. We also see three additional regional trends are likely to increase participation of local institutional and private investors in Latin America’s private markets:

| • | Low interest rates—In Brazil, for example, interest rates had historically been in double digits for local currency debt, and through successive decreases, reached 4.50% p.a. as of December 31, 2019, further decreasing over the course of 2020 to 2.00% p.a. as from August 5, 2020. This trend, to varying |

5

Table of Contents

| degrees occurred in other markets in the region, greatly accelerated the regional transformation of domestic capital markets, which are now able to provide more effective financing for consumer spending and firms’ operations as local currency debt becomes affordable. This also accelerated a broad portfolio reallocation by individuals, institutional investors and family offices, who, seeking returns, started to move from traditional instruments and into new investment options, which has fueled a boom in local listings in the public markets, and also to private markets. |

| • | Bank disintermediation—Particularly in Brazil, whose traditional banking system concentrated over 90% of assets under custody in 2018 and since then has seen the emergence of independent brokers and advisors that have flourished based on a value proposition focused on better service and a broader and more cost-effective product portfolio. |

| • | Increased local financial awareness—As shown not only by the recent trends in the number of registered customers in the B3 S.A.—Brasil, Bolsa, Balcão, or B3, Latin America’s largest stock exchange market, which more than quadrupled in the last three years, but also by the number of listed alternative products such as real estate investment trust, or REITs, which grew from 26 in 2017 to 70 in 2019, with an increase in trading volume of more than 4.5x in the same period. |

Our Competitive Strengths

Since our inception, we have grown to become one of the leading private markets firms focused on investing in Brazil and elsewhere in Latin America in terms of capital raised. We believe the following competitive strengths allow us to capitalize on industry trends and position us well for future growth:

Sustained strong investment performance track record across market cycles. We have produced strong long-term investment performance across our product offerings, generating consistent outperformance relative to benchmarks.

Since our inception in 1994 and as of September 30, 2020, we managed the deployment of more than US$17.0 billion through capital raised by our products, capital raised in primary offerings in IPOs and follow-ons, debt raised by underlying companies and capital expenditures sourced from operational cash flow of underlying companies, encompassing more than 90 investments and over 215 underlying transactions. As of December 31, 2019, approximately 51% and 66% of the total invested capital since inception for our flagship private equity and infrastructure products were marked above 2.0x MOIC in U.S. dollars and Brazilian reais, respectively (35% and 56% as of September 30, 2020, respectively). In addition, only 7% and 3% were marked below 1.0x MOIC in U.S. dollars and Brazilian reais, respectively (15% and 8% as of September 30, 2020, respectively).

As of December 31, 2019, when compared to PMEs, based on the MSCI Latin America and MSCI Emerging Markets indexes, our flagship funds delivered attractive excess returns. Infrastructure generated 10.1 percentage points, or p.p., above the PME MSCI LatAm and 7.2 p.p. over PME MSCI EM, while our flagship private equity funds generated 7.0 p.p. over PME MSCI LatAm and 8.5 p.p. over PME MSCI EM. As of September 30, 2020 and December 31, 2019, the cash-weighted net IRR consolidated for all our flagship private equity and infrastructure products since inception was 10.6% and 14.4% in U.S. dollars and 20.2% and 20.7% in Brazilian reais, respectively. As of September 30, 2020 and December 31, 2019, our equal-weighted net IRR, which is another usual metric to measure performance, was 28.3% and 28.8% in U.S. dollars and 30.1% and 30.7% in Brazilian reais, respectively.

We believe these results place us among the top private markets managers in the region in terms of performance. As of December 31, 2019, our flagship private equity products have returned a pooled cash-weighted net IRR of 16.1%, which exceeds the average of Latin American private equity managers by 13.0 p.p.

6

Table of Contents

Even comparing to emerging Asia, which is recognized as a high growth region, our private equity funds delivered a 4.3 p.p. premium in 2019. Additionally, our returns have consistently placed our flagship private equity products in the top quartile of performance of funds in emerging markets in most vintages according to Hamilton Lane and Cambridge Associates.

We believe an important driver in our ability to generate attractive returns is our ability to create operational value. We typically pursue investment strategies that can enable value to be created through operational improvements, without depending on economic cycles or financial engineering. We estimate that nearly 60% of value added to our private equity investments generally comes from direct operational improvements, such as revenue growth and margin expansion, and with respect to our infrastructure investments, from capturing a development premium on green-field projects. We estimate that the remainder of the value added to our private equity investments comes largely from the multiple premium we capture by consolidating small to medium sized companies into sector leaders.

In addition, our analytical tools, research capabilities, databases and processes have been developed and refined over more than 30 years of experience in successful private markets investing, creating an investment methodology that is repeatable and sustainable, but difficult for competitors to replicate.

Strong client relationship model and capital raising capabilities. We are one of the leading private markets firms in Latin America in terms of capital raised and therefore are among the world’s largest institutional investors focused on investments in Latin America. We have raised a total of US$16.6 billion since inception as of September 30, 2020, with a total of US$8.7 billion raised since 2015 including co-investments. Preqin’s 2020 Global Private Equity & Venture Capital Report ranks us as the number one fund manager by total capital raised for private equity funds in the past ten years outside North America, Europe and Asia. Our capital raising capabilities rely on a team of 22 individuals ranging from client coverage and product-specialists to investor relations officers. Our product specialist officers in the investment team have deep knowledge of investment and portfolio strategy and performance, not only to keep LPs and prospective LPs well-informed but also to promote a clearer understanding and deeper appreciation of our strategy, thus facilitating a richer dialogue and exchange and fostering a stronger bond with our LPs. We have accumulated years of data regarding the investment criteria and transaction behavior of many LPs, and we are well-positioned to match our clients with the most appropriate investment opportunities.

Our ability to access key decision makers, to understand our clients well, to respond to their needs and priorities, and to make our message well-understood is translated into strong capital raising and distribution capabilities that, although positively supported by investment performance, we believe is recognized by our clients as one of our distinctive strengths. We believe our capital raising capabilities are scalable to support our growth plans, based on our team, disciplined relationship-model and systematic go-to-market approach.

Highly attractive and scalable business model with robust growth trajectory. We participate in an industry that is growing rapidly. We believe we are among the market leaders in our industry in Latin America and have a strong reputation in investing and client service and our goal is to exceed the industry’s growth rate, driving continued expansion of our recurring management fees and incremental performance fees.

From 2009 to 2019, our AUM increased at a compound annual growth rate, or CAGR, of 20%. For details on our AUM growth, see“—Our Business—AUM Patria (US$ billion) and number of funds.” We have a strong business with two main revenue streams: management fees and performance or incentive fees. The first provides us with highly predictable cash flows, as we enter into closed ended fund management agreements with our LPs, usually with terms of 10 to 12 years. As of December 31, 2019, based on our annual estimates, over 80% of our total management fees projected for the next three years were already contracted, considering our investment and divestment forecasts and the expected performance of evergreen funds. As of December 31, 2019, 74% of our

7

Table of Contents

committed capital had a remaining tenor of over five years, while 23% was from three to five years, and only 2% was below three years, in addition to 1% of perpetual capital. As of September 30, 2020, 73% of our committed capital had a remaining tenor of over five years, while 13% was from three to five years, and 12% was below three years, in addition to 3% of perpetual capital. Performance fees give us the possibility of upside remuneration associated with performance. As of September 30, 2020 and December 31, 2019 the sum of our non-realized performance fees was over US$60.0 million and US$290.0 million, respectively. This metric is defined in the section “Presentation of Financial and Other Information—Certain Terms Used in this Prospectus as KPIs to Measure Operating Performance.” As of September 30, 2020 and December 31, 2019, 86% and 85% of our AUM was eligible for performance revenue and 79% and 78% was subject to catch-up of which 89% and 87% was subject to full catch up, respectively. The full catch-up clause is intended to make the manager whole so that the performance fee is a function of the total return and not solely the return in excess of the preferred return. Given the highly recurring nature of our earnings, we have paid substantial dividends. In the nine months ended September 30, 2020 and in the years ended December 31, 2019 and 2018, dividends paid to our shareholders were US$39.5 million, US$46.9 million and US$38.0 million, respectively.

The long-lived, stable nature of our positive working capital enhances the resiliency of our business model. The nature of our operations enables us to collect part of our management fees at the beginning of each semester (as deferred revenues typically recorded in interim periods) before incurring day-to-day business expenses. Adding to the strength of our balance sheet, we do not have relevant debt obligations and do not depend on leverage to grow. Our exponential growth in AUM was accompanied by relevant investments in our systems and back-office. Automatized and efficient, our back-office is scalable for larger volumes of investments and can accommodate growth without material investments in infrastructure.

Seasoned management team with entrepreneurial spirit and professional culture. As of September 30, 2020 we had a senior management team, comprised of 46 members, who averaged 20 years of investment experience. Most of our partners have been working together for more than 15 years, while partners and directors for more than 10 years on average. The senior team is highly aligned with our clients’ objectives, as approximately 3.5% of the capital commitments to our active funds as of December 31, 2019 were made by the partners and the Patria team. Our team includes more than 64 investment professionals who are focused on private markets investing and 22 client coverage professionals based in São Paulo, New York, Los Angeles, London, Dubai, and Hong Kong. Our team blends professionals with complementary competences and experiences, who bring different perspectives to our investment and management decisions, all of whom are committed to sustainable solutions and fully adherent to environmental, social and governance, or ESG, standards. Our operating partners, usually, former C-level executives from the sectors in which we invest, our value creation team staffed by senior functional specialists, and our transactions group of M&A specialists complement the business development competences of our investment team. We also have what we believe to be one of the best entry level programs in our sector: Patria Academy, our internship program with approximately 100 applicants per position. We also offer our employees the opportunity to rotate between multiple roles. For more information on our management, see “Management.”

Our entrepreneurial spirit, professional culture, and partnership proposition disseminated at scale are powerful variables that contribute to our execution capabilities and most importantly to the attraction and retention of talents across all of our different areas. We believe that our recognized brand, aligned with our award-winning internship program, allows us to attract the best in class students from top universities constantly sourcing young talents. Our name, together with our cutting edge deals, and our multiple and challenging career paths attract the best people in the market. Our culture, aligned with a meritocratic environment and a partnership open to all and fast career development, help us to retain our talents.

Unparalleled brand equity as one of the thought leaders in the region. The performance of our funds attracts and retains many of the largest and most relevant institutional global investors. We evolved to become

8

Table of Contents

one of the trusted partners to many of our clients in Latin American investment decisions. The recognition from such renowned investors reinforces our brand equity and strongly leverages our capital raising capabilities to attract new investors and increase our share of wallet of current clients.

Our more than 30 years of successful investments in Latin America have made Patria one of the most recognized private markets investors in the region, especially in the industries in which we focus. Our strong reputation in the Latin American business community attracts talented entrepreneurs, who naturally approach us when seeking a partner to grow, allowing Patria to invest at attractive entry valuations.

Divestment activities are also positively impacted by our brand equity recognition. Public markets and large corporations, which are the usual buyers of our portfolio companies, recognize our track record of building and structuring great companies, with good governance, teams and processes.

Business Growth Strategy

The alternative investment industry has experienced significant and consistent growth, which we expect to continue and contribute to our future growth. Given our market position as one of the leaders in terms of capital raised and strong reputation in investing and client service, our objective is to continue to leverage the following strategic advantages to exceed the industry growth rate. We believe that the following will continue to serve as the primary drivers of our growth:

Grow addressable market. Alternative investments are expected to continue to grow vigorously and sustainably in the long-term. According to Preqin’s The Future of Alternatives 2020 study, private markets AUM is expected to reach US$12.9 trillion by 2025 with a 12.4% CAGR from 2020 to 2025. We believe that many global investors are currently underinvested in private markets asset classes and that capturing capital inflows into private capital investing from international global markets represents a significant growth opportunity for us. We believe that global investors will increasingly: (i) search for higher returns, especially by institutional investors, as they face challenges to reach target returns or to close actuarial gaps, (ii) seek more exposure to the consistent historical outperformance of private versus public markets, and (iii) make use of significant liquidity available in financial markets.

We believe the penetration of Latin America investments as a share of total global private markets investments can increase from the historically low levels. According to Preqin database, as of December 2019, AUM managed by Latin American managers accounted for less than 1% of global AUM, while Latin America GDP in 2019 represented 6% of global GDP. We believe that the volume of capital flowing to private markets in Latin America will increase substantially, driven by positive economic and currency cycles and the low correlation between the Brazilian economy and global economy, which makes Brazil an attractive diversification alternative for global investors. In addition, Brazil has been experiencing unprecedented low interest rates, supporting a financial deepening that may drive a substantial reallocation of local capital into private market investments.

Continue to diversify and grow our client base of large global investors. We have a strong, diversified and sophisticated client base of over 300 LPs, of which the top 20 investors accounted for US$4.7 trillion in AUM across private markets. As of September 30, 2020, our investors include: (i) 6 of the world’s 10 largest sovereign wealth funds (including LPs with indirect investments); (ii) 10 out of the world’s 20 largest pension funds; and (iii) 6 out of the US’s 10 largest pension funds. As of September 30, 2020, more than 60% of total commitments to our funds were made from LPs investing with us for over 8 years. From 2014 to September 2020, the commitments among recurring clients increased by over 33% for our flagship products. We intend to continue to expand our relationships with existing clients and also intend to capitalize on significant opportunities in new client segments globally and in Brazil, such as high-net-worth individuals, regional and local institutional

9

Table of Contents

investors and also mass affluent investors. We believe these investors offer an attractive opportunity to further diversify and grow our client base because many of them only recently have begun to invest in, or increase their allocations to, private markets investments.

Continue to increase our innovative private markets product portfolio. Starting from our traditional private equity platform, we developed a wide range of products to better meet the needs of our ever-growing client base. Today, our portfolio comprises sophisticated private equity and infrastructure funds as well as more accessible products such as our Constructivist Equity Fund and listed real estate funds.

We believe there is growing demand for an expanded product offering leveraging on our investment approach and current capabilities, which could address the specific needs of both our current global institutional client base and potential Latin American investors, including institutional funds, private wealth managers and the affluent retail investors. We expect to continue developing new offerings, including, for example, more co-investment alternatives and sector- or thematic-focused funds (e.g. Core Infrastructure and Impact Private Equity).

Expand access to channels. While we have established a solid direct communication program with global institutional investors, we aim to continue leveraging our existing investor relations and marketing capabilities to access new relationships and investor segments. In addition to continuing to cultivate our rich direct relationship with our current global client base, we expect that deepening our relationship with distributors, private banks, and digital platforms may significantly enhance the marketing potential of our products in Brazil, in Latin America, and globally.

Tap a growing demand for private market investment products in Latin America. We believe that we are uniquely positioned to reap the benefits of secular trends in Latin America that are driving growing demand for private market investment products. Historically low interest rates coupled with bank disintermediation create opportunities for growth. We believe our platform has the investment track record and distribution expertise required to expand our capital raising in Latin America by leveraging and expanding our existing local investment products, such as our CEF, which as of September 30, 2020 had approximately US$200.0 million of AUM and a net compounded annualized return of 34.3% in Brazilian reais or 16.2% in U.S. dollars.

Why We Are Going Public

We have decided to become a public company for the following reasons:

| • | to fund our future GP capital commitments in light of our expansion plan; |

| • | to become even more attractive by way of having publicly-traded securities that can be used as consideration for mergers and acquisitions, boosting our competitive advantages as a buyer and as a partner for other platforms; |

| • | to enhance our ability to continue investing in our teams, both by providing attractive equity compensation packages to our existing employees and by bringing new talents to our organization; and |

| • | to accelerate our growth through acquisitions, consolidating our position as a leading private markets investment firm in terms of capital raising in Brazil and Latin America. |

Recent Developments

Our and our funds’ results for the three months and the year ended December 31, 2020 are not yet complete and will not be available until after the completion of this offering. Accordingly, the following discussion reflects certain preliminary information regarding certain of our and our funds’ results and key performance indicators

10

Table of Contents

for these periods. The results and key performance indicators discussed below are preliminary and subject to revision based upon the completion of our and our funds’ year-end financial closing processes as well as the related audit of the results of operations for the year ended December 31, 2020. There is no assurance that these results are indicative of our or our funds’ final results for the three months and the year ended December 31, 2020 or in any future period.

Preliminary Results for Fourth Quarter of 2020 and Full Year 2020

In the three months ended December 31, 2020, we expect: (i) our revenue from services (excluding performance fees) to have increased slightly as compared to the three months ended December 31, 2019, primarily as a result of higher revenues from management fees, partially offset by lower incentive fees; (ii) our Fee Related Earnings (FRE) to have increased slightly as compared to the three months ended December 31, 2019, as a result of the slightly higher revenue from services (excluding performance fees); and (iii) not to have Performance Fees realizations.

In the year ended December 31, 2020, we expect: (i) our revenue from services (excluding performance fees) to have slightly decreased as compared to the year ended December 31, 2019, primarily as a result of the lower incentive fees of our CEF funds, partially offset by higher management fees; (ii) our cost of services rendered to have decreased as compared to the year ended December 31, 2019, primarily as a result of lower bonuses and rewards because of lower incentive fees related to CEF Funds; (iii) our Fee Related Earnings (FRE) to have increased as compared to the year ended December 31, 2019, primarily as a result of the lower cost of services rendered, partially offset by the lower revenue from services (excluding performance fees); and (iv) not to have Performance Fees realizations.

Funds Returns

The table below provides a comparison of returns for the periods indicated:

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||

| Low | High | Actual | Low | High | Actual | |||||||||||||||||||

| (In US$) | (In R$) | |||||||||||||||||||||||

| Cash Weighted (Net IRR) |

||||||||||||||||||||||||

| Private Equity (core + co-investments) |

15.7 | % | 16.3 | % | 16.1 | % | 22.2 | % | 22.6 | % | 20.8 | % | ||||||||||||

| Infrastructure (core + co-investments) |

5.6 | % | 6.6 | % | 10.1 | % | 18.7 | % | 19.7 | % | 20.3 | % | ||||||||||||

| PE + Infra (core + co-investments) |

12.8 | % | 13.6 | % | 14.4 | % | 21.5 | % | 22.1 | % | 20.7 | % | ||||||||||||

| Equal Weighted (Net IRR) |

||||||||||||||||||||||||

| Private Equity (core + co-investments) |

29.4 | % | 29.6 | % | 29.6 | % | 31.3 | % | 31.5 | % | 31.3 | % | ||||||||||||

| Infrastructure (core + co-investments) |

11.1 | % | 12.9 | % | 12.5 | % | 25.4 | % | 27.0 | % | 23.2 | % | ||||||||||||

| PE + Infra (core + co-investments) |

28.7 | % | 28.9 | % | 28.8 | % | 30.9 | % | 31.1 | % | 30.7 | % | ||||||||||||

| Net Compounded Annualized Return |

||||||||||||||||||||||||

| CEF |

19.6 | % | 19.6 | % | 35.7 | % | 35.7 | % | 40.1 | % | ||||||||||||||

| MSCI LATAM (Alpha in p.p.) |

||||||||||||||||||||||||

| Private Equity (core + co-investments)—CW |

11.6 | 12.2 | 7.0 | |||||||||||||||||||||

| Infrastructure (core + co-investments)—CW |

11.7 | 12.7 | 10.1 | |||||||||||||||||||||

| MSCI EM (Alpha in p.p.) |

||||||||||||||||||||||||

| Private Equity (core + co-investments)—CW |

7.1 | 7.7 | 8.5 | |||||||||||||||||||||

| Infrastructure (core + co-investments)—CW |

2.4 | 3.4 | 7.2 | |||||||||||||||||||||

11

Table of Contents

In 2020, considering mid-range returns, our funds achieved a home run ratio (defined as companies with market value at or above 2x multiple on invested capital, or MOIC) represented, for our flagship private equity and combined private equity and infrastructure products, 52% and 45% of the total equity value of the companies held by such funds in U.S. dollars, respectively (or 68% and 71% in Brazilian reais, respectively). Based on the same assumptions, our funds had a loss ratio (defined as companies with market value below 1x MOIC) of 12% and 12%, respectively (or 7% and 7%, in Brazilian reais, respectively).

Assets under Management

The following table presents certain key operating performance metrics for the periods indicated:

| For the Year Ended December 31, | ||||||||||||

| 2020 | 2019 | |||||||||||

| Low | High | Actual | ||||||||||

| (in US$ millions) | ||||||||||||

| Assets under management (AUM) |

14,195 | 14,621 | 14,748 | |||||||||

| Private Equity AUM |

8,480 | 8,775 | 8,511 | |||||||||

| Infrastructure AUM |

4,662 | 4,758 | 4,765 | |||||||||

| Brazil-specific Products AUM |

1,053 | 1,088 | 1,473 | |||||||||

| Fee earning AUM |

7,564 | 7,862 | 6,870 | |||||||||

| Private Equity AUM |

3,307 | 3,387 | 2,958 | |||||||||

| Infrastructure AUM |

3,235 | 3,401 | 3,187 | |||||||||

| Brazil-specific Products AUM |

1,022 | 1,074 | 724 | |||||||||

| Performance revenue eligible AUM |

12,109 | 12,475 | 12,481 | |||||||||

| Private Equity AUM |

7,624 | 7,890 | 7,461 | |||||||||

| Infrastructure AUM |

3,810 | 3,889 | 4,071 | |||||||||

| Brazil-specific Products AUM |

675 | 697 | 949 | |||||||||

| Non-realized performance fee |

248 | 305 | 292 | |||||||||

As of December 31, 2020, the expected AUM breakdown of our Brazil-specific Products was between: (i) US$253.1 million and US$266.1 million for Listed Equities (CEF); (ii) US$561.2 million and US$577.3 million for Real Estate; and (iii) US$238.9 million and US$245.0 million for Credit.

Fundraising and Client Metrics

In 2020, we raised US$1.4 billion in new capital, increasing our total historical fundraising volume to US$16.6 billion as of December 31, 2020 compared to US$15.2 billion as of December 31, 2019. Considering capital raised from Brazilian investors, in 2020 we raised R$3.0 billion of new capital, totaling R$7.3 billion since 2009.

Capital Deployment

In 2020, we deployed US$1.5 billion of capital from our funds. As of December 31, 2020, our private equity strategy had invested in 40 platforms with more than 240 transactions since inception, while our infrastructure strategy had invested in 20 platforms, 70% of which were newly created by us. In 2020, our private equity and infrastructure strategies carried out an aggregate of 37 transactions and new investment projects. Considering investments made in 2020, approximately 88% of capital deployed through our private equity and infrastructure strategies was allocated to our core investment sectors, given we deployed approximately 81% for private equity and 100% for infrastructure.

12

Table of Contents

Payment of Dividends

On December 28, 2020, we paid dividends to our shareholders in an aggregate amount of US$25.0 million.

In addition, on January 21, 2021, we paid dividends to our shareholders in an aggregate amount of US$23.3 million.

Cautionary Statement Regarding Preliminary Information

The preliminary results and key performance indicators discussed above are subject to revision based upon the completion of our and our funds’ year-end financial closing processes as well as the related audit of the results of operations for the year ended December 31, 2020. The information presented herein should not be considered a substitute for full financial statements prepared in accordance with IFRS. We caution you that these preliminary results and indicators are not guarantees of future performance or outcomes and that actual results may differ materially from those described above. For additional information, see “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.” This information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

Our Corporate Structure

On December 1, 2020, we entered into a purchase agreement among Blackstone and certain of its affiliates, Messrs. Alexandre T. de A. Saigh, Olimpio Matarazzo Neto and Otavio Lopes Castello Branco Neto, or the Founders, and certain entities affiliated with the Founders, or the Founder Entities, and Patria Brazil, as part of a corporate reorganization pursuant to which (1) Patria Holdings acquired 100,000 of our common shares (prior to giving effect to the Share Split (as defined below)) (or 10% of our existing common shares) that were beneficially owned by Blackstone (the “Purchase”) and (2) the 19.6% non-controlling interest in Patria Brazil currently held by Blackstone and the 29.4% non-controlling interest in Patria Brazil currently held by one of the Founder Entities will be reorganized as follows (the “Roll-Up”): (i) the direct interest held by Blackstone in Patria Brazil will be contributed to us in exchange for three of our Class A common shares to be issued to Blackstone; and (ii) the direct interest held by such Founder Entity will be redeemed in its entirety at par value for a promissory note and one of the Founder Entities will contribute the promissory note to us, in consideration for which we will issue seven of our Class B common shares to Patria Holdings. We refer to these transactions collectively in this prospectus as our “corporate reorganization.” The Purchase closed on January 6, 2021 and the Roll-Up is expected to close in the first half of 2021. With respect to any dividend we pay in connection with the 2020 calendar year, we have agreed to pay the amount of such dividend relating to such 100,000 shares to Blackstone. Upon the consummation of our corporate reorganization, Patria Brazil will become a wholly-owned subsidiary of the Company. Additionally, on January 13, 2021, we carried out a share split of 117.0:1 or the Share Split. As a result, our share capital represented by 1,000,000 shares was increased to 117,000,000 shares.

After accounting for the new Class A common shares that will be issued and sold by us in this offering and the Share Split, we will have a total of 133,650,000 common shares issued and outstanding immediately following this offering, an aggregate of 81,900,000 of these shares will be Class B common shares beneficially owned by Patria Holdings, and an aggregate of 51,750,000 of these shares will be Class A common shares beneficially owned by investors purchasing in this offering and Blackstone (in the aggregate). See “Principal and Selling Shareholder.” In addition, following the offering we will be a “controlled company” within the meaning of the Nasdaq corporate governance standards and as such plan to rely on available exemptions from certain Nasdaq corporate governance requirements.

13

Table of Contents

The following chart shows our corporate structure and equity ownership, after giving effect to this offering and our corporate reorganization. This chart is provided for illustrative purposes only and does not show all of the legal entities:

Summary of Risk Factors

An investment in our Class A common shares is subject to a number of risks, including risks relating to our business and industry, risks relating to Brazil and risks relating to the offering and our Class A common shares. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Risks Relating to Our Business and Industry

| • | The global outbreak of the novel coronavirus, or COVID-19, has caused severe disruptions in Latin America and global economies and is adversely impacting, and may continue to adversely impact, our performance and results of operations. |

| • | Difficult market and geopolitical conditions can adversely affect our business in many ways, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition. |

| • | A period of economic slowdown, which may be across one or more industries, sectors or geographies, could contribute to adverse operating performance for certain of our funds’ investments, which would adversely affect our operating results and cash flows. |

14

Table of Contents

| • | An increase in interest rates and other changes in the debt financing markets could negatively impact the ability of our funds and their portfolio companies to obtain attractive financing or refinancing and could increase the cost of such financing if it is obtained, which could lead to lower-yielding investments and potentially decrease our net income. |

| • | If we cannot make the necessary investments to keep pace with rapid developments and change in our industry, the use of our services could decline, reducing our revenues. |

| • | Our revenue, earnings, net income and cash flow can all vary materially and be volatile from time to time, which may make it difficult for us to achieve steady earnings growth on a quarterly basis and may cause the price of our Class A common shares to decline. |

Certain Factors Relating to Latin America

| • | Governments have a high degree of influence in the economies in which we operate. The effects of this influence and political and economic conditions in Brazil and Latin America could harm us and the trading price of our Class A common shares. |

| • | Developments and the perceptions of risks in other countries, including other emerging markets, the United States and Europe, may harm the economy of the countries in which we operate and the trading price of our Class A common shares. |

| • | Economic uncertainty and political instability in Brazil and other countries of Latin America, including as a result of ongoing corruption investigations, may harm us and the price of our Class A common shares. |

| • | Inflation and government measures to curb inflation may adversely affect the economies and capital markets in some of the countries in where we operate, and as a result, harm our business and the trading price of our Class A common shares. |

| • | Exchange rate instability may have adverse effects on the Brazilian and other countries of Latin American economies, which may, in turn affect our business and the trading price of our Class A common shares. |

Certain Factors Relating to Our Class A Common Shares and the Offering

| • | There is no existing market for our common shares, and we do not know whether one will develop to provide you with adequate liquidity. If our share price fluctuates after this offering, you could lose a significant part of your investment. |

| • | Patria Holdings will own all of our issued and outstanding Class B common shares, which represent approximately 94.1% of the voting power of our issued share capital following the offering, and will control all matters requiring shareholder approval. Patria Holdings’ ownership and voting power limits your ability to influence corporate matters. |

| • | Class A common shares eligible for future sale may cause the market price of our Class A common shares to drop significantly. |

| • | We are a Cayman Islands exempted company with limited liability. The rights of our shareholders, including with respect to fiduciary duties and corporate opportunities, may be different from the rights of shareholders governed by the laws of U.S. jurisdictions. |

Corporate Information

We were incorporated in Bermuda in July 2007 as a limited liability exempted company and changed the jurisdiction of our incorporation to the Cayman Islands on October 12, 2020. Our principal executive offices are

15

Table of Contents

located at 18 Forum Lane, 3rd floor, Camana Bay, PO Box 757, KY1-9006, Grand Cayman, Cayman Islands. Our telephone number at this address is +1 345 640 4900.

Investors should contact us for any inquiries through the address and telephone number of our principal executive office. Our principal website is www.patria.com. The information contained in, or accessible through, our website is not incorporated into this prospectus or the registration statement of which it forms a part.

Implications of Being an Emerging Growth Company

As a company with less than US$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | the ability to present more limited financial data for our initial registration statement on Form F-1, including presenting only two years of audited financial statements and only two years of selected financial data, as well as only two years of related management’s discussion and analysis of financial condition and results of operations disclosure; |

| • | an exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act, in the assessment of our internal control over financial reporting which would otherwise apply in connection with the filing of our second annual report on Form 20-F following consummation of this offering; |

| • | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation and golden parachute arrangements. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than US$1.07 billion in annual revenue, have more than US$700.0 million in market value of our Class A common shares held by non-affiliates or issue more than US$1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than you might get from other public companies in which you hold equity.

In addition, under the JOBS Act, emerging growth companies who prepare their financial statements in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP, can delay adopting new or revised accounting standards until such time as those standards apply to private companies. Given that we currently report and expect to continue to report under International Financial Reporting Standards, or IFRS, as issued by the IASB, we will not be able to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB. In addition, following the offering, we will be a “controlled company” within the meaning of the Nasdaq corporate governance standards and as such plan to rely on available exemptions from certain Nasdaq corporate governance requirements.

Impacts of COVID-19

Since the start of the COVID-19 pandemic, most emerging economies where we operate have seen portfolio capital outflows from equity and fixed income markets to safe haven assets such as U.S. treasuries and gold.

16

Table of Contents

Brazil, in particular, had approximately US$32.0 billion of short-term capital outflows in the first five months of 2020. As a result, the Brazilian real depreciated 29% against the U.S. dollar year-to-date as of September 30, 2020; and according to our estimates based on purchasing power parity, or PPP, the Brazilian real had 30% undervaluation in comparison to the U.S. dollar. Also, according to our estimates based on PPP, the same would be true for currencies of other major economies in the region, such as Mexico (23%), Colombia (17%) and Chile (12%).

Despite the magnitude of the ongoing effects of the pandemic, we believe that our results have demonstrated resilience. For the nine months ended September 30, 2020 our net income was 9.9% higher when compared to the same period of 2019. Over 70% of our revenues in the nine months ended September 30, 2020 were in U.S. dollars as of September 30, 2020, which reduced the effects of currency devaluation in the countries in which we operate on our operational results. Over 80% of our expected management fees for the next three years were already contracted, given the nature of our business and our long-term contracts with our clients. Additionally, we believe the structurally positive working capital of our business allowed us to endure the pandemic without experiencing significant liquidity issues, given we are able to collect part of our management fees at the beginning of each semester (as deferred revenues typically recorded in interim periods) before incurring day-to-day business expenses.

We also adapted our business and operations to respond to the COVID-19 pandemic in an energetic and disciplined manner. Our priority was to look after our most important asset: our people. In March, we established a Crisis Committee composed of certain senior officers and with the mandate to focus on the integrity and safety of our employees, of those of our portfolio companies, and of our suppliers. While offering technology and connectivity to allow for appropriate remote work conditions, we offered personal support through Assist Care (one of our businesses, which provided remote medical care assistance and COVID-19 monitoring of our employees), online fitness classes, online psychological assistance, among other initiatives. We also promoted a network of solidarity that helped thousands of people in several communities surrounding our portfolio companies, raising and directing approximately US$4 million in donations from April to June 2020. Finally, we were closer than ever to our clients, with over 1,850 interactions year-to-date as of September 30, 2020.

Regarding our operations, despite the general economic crisis and investors’ risk-aversion, we managed to continue to fundraise, invest, and divest consistently. In June 2020, we concluded a capital raise of US$2.0 billion for our 4th infrastructure fund, the largest fund in Latin America exclusively dedicated to infrastructure investments. In the nine months ended September 30, 2020, we were able to deploy over US$1.1 billion taking advantage of our experience in sectors we believe are resilient to economic downturns, as well as attractive valuations. In September 2020, we were also able to successfully divest from assets, such as Hidrovias do Brasil, one of the largest IPOs in Latin America in 2020, and in March 2020, we divested from Argo, an electric power transmission company from our Infrastructure Fund III with a gross multiple of invested capital, or MOIC, of 4.4x, and a gross internal rate of return, or IRR, of 74.2% (both measured in U.S. dollars). However, we also exercised caution in view of high volatility and postponed some of our planned divestments with the hopes for better market conditions or further appreciation of our assets in the future.

The resilience of our investing model is largely based on investing on sectors resilient to economic downturns and on active operational value creation. We believe that our investing model, together with a well-structured crisis response plan, allowed us to mitigate the operational impacts of the COVID-19 pandemic on our portfolio companies—76% of the net asset value of our investments in Brazilian reais as of September 30, 2020 were above or at pre-COVID-19 levels, reflecting our funds’ resilient net IRR. In particular, the consolidated cash-weighted net IRR in Brazilian reais for all our flagship private equity and infrastructure products, which represent approximately 90% of our AUM, was 20.2% and 20.7% since inception to September 30, 2020 and December 31, 2019, respectively. This compares to the consolidated cash-weighted net IRR in U.S. dollars for such funds of 10.6% and 14.4% since inception for the same periods, respectively, as a result of Latin American

17

Table of Contents

currencies’ depreciation against the U.S. dollar in 2020, which had a negative impact to the dollar-denominated net asset value of our portfolio companies and led to short-term volatility on our funds’ returns. We believe this decrease in returns does not reflect the operational performance of our assets as they are assessed and audited at year-end, on a yearly basis.

In addition, certain of our portfolio companies have been meeting or outperforming their expected operational results for 2020 on a Brazilian reais basis, and therefore we believe returns may already show signs of recovery by the end of 2020. Primarily as a result of the negative impact of the COVID-19 pandemic on our portfolio companies due to the depreciation of the real against the U.S. dollar, our non-realized performance fee balance, which measures our current total expectation of cash inflow from performance fee related to our operational funds by the end of each period, decreased from US$292 million in December 31, 2019 to US$61 million in September 30, 2020. This balance represents non-realized performance fee revenues, and the long-term nature of our funds allows us to keep our investments in our portfolio for longer periods, giving us the opportunity to protect our assets from short-term impacts of economic downturns. Although the duration of the economic impact of the COVID-19 pandemic is still uncertain, we currently believe that, in general, we will be able to continue to hold and protect our assets. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Non-Realized Performance Fee.” Our other non-GAAP measures, such as our AUM, are also impacted in similar ways.

Given the factors discussed above regarding currency depreciation, the fact that the valuation of our portfolio companies and assets are only audited at year-end, and that, in general lines, certain of our portfolio companies have been meeting or outperforming their planned expected operational results for 2020 on a local-currency basis, we believe that certain of our key performance indicators as of September 30, 2020, which are based on the U.S. dollar-denominated net asset value of our companies and assets, such as funds’ returns, AUM and non-realized performance fee in U.S. dollars, may not be particularly representative of our operating performance in the longer-term.

See “Risk Factors—Certain Factors Relating to Our Business and Industry—The global outbreak of the novel coronavirus, or COVID-19, has caused severe disruptions in Latin America and global economies and is adversely impacting, and may continue to adversely impact, our performance and results of operations,” “Risk Factors—Certain Factors Relating to Our Business and Industry—The COVID-19 pandemic has had and is expected to continue to have a negative impact on global, regional and national economies, and we would be materially adversely affected by a protracted economic downturn” and “Industry—Growth prospects.”

18

Table of Contents

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common shares. You should carefully read this entire prospectus before investing in our Class A common shares including “Risk Factors” and our consolidated financial statements.

| Issuer |

Patria Investments Limited |

| Selling shareholder |